Why the Finance Industry is Pivoting from MBAs to Skills-First Hiring

Faced with a talent drought that is only getting worse, financial firms are increasingly turning to skills-based hiring to identify top talent. In 2025, it’s about will and skill rather than degrees and pedigrees. An MBA used to be the go-to qualification for top jobs. It showed that a candidate had the right education, network, and business knowledge.

But things are changing, and the debate around MBA vs. skill-based hiring is reshaping how employers evaluate talent. Historically, an MBA from a top institution has often been regarded as the gold standard in finance. It provided a broad business foundation, a prestigious network, and signaled a candidate’s ambition and analytical rigor.

However, the rapid pace of technological innovation, the rise of fintech, and the increasing complexity of data have exposed the limitations of a purely traditional, generalized MBA. In 2025, finance companies are looking for real-world skills over traditional degrees.

The emphasis has shifted from foundational knowledge alone to demonstrable proficiency in areas like Python, Power BI, advanced financial modeling, enterprise application testing, and specialized fintech applications. This isn’t to say MBAs are worthless, but their value is now often amplified by, or even secondary to, concrete technical and problem-solving abilities.

Skill-Based Hiring Trends

Skill-based hiring is becoming a major trend, and for good reason. Instead of focusing only on degrees or job titles, companies are now looking at what truly matters: your skills. According to the Deloitte Skill-Based Organization Survey (May-Jun 2022), 73% of workers believe skill-based practices would improve their work experience. And they’re right. When you, as a recruiter or employer, focus on skills, you open up access to a wider talent pool and give people a fairer chance to grow.

Deloitte Insights also notes that skills-based organizations are 98% more likely to retain high performers and 79% more likely to foster a positive workforce experience, underscoring how a skills-first mindset reduces turnover and accelerates onboarding in finance roles.

As per the same survey, 89% of executives agree that skills are now central to how organizations define work, manage careers, and value their employees. That means moving away from rigid job descriptions to flexible roles based on what a person can do, not just what their resume says.

This shift is a win-win. Recruiters match roles with talent more accurately, and employees can upskill and advance based on capability, not just credentials. Skill-based hiring in finance helps build more agile and engaged teams, exactly what modern workplaces need.

The Shift towards Skill-Based Hiring

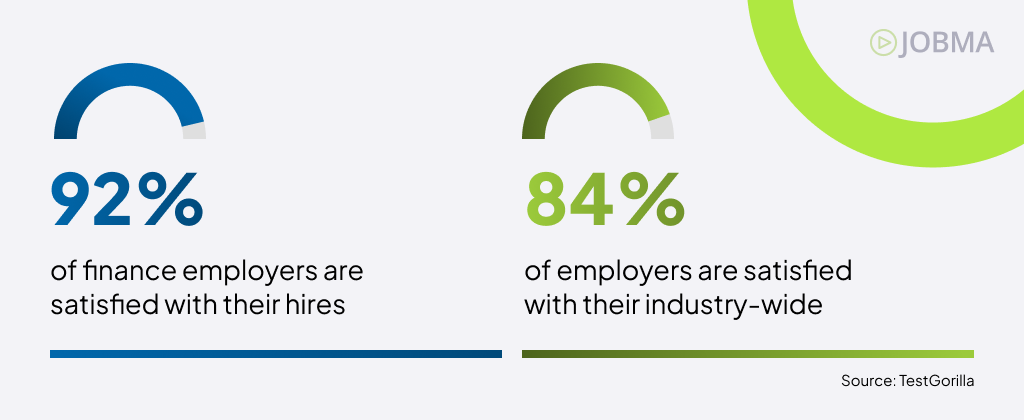

The financial sector is undergoing rapid transformation, and recruitment practices are evolving to keep up. According to the Fintech Factor report by TestGorilla, in the past 12 months, 92% of finance employers reported satisfaction with their hires, 8 percentage points higher than the industry average of 84%. This indicates that finance employers are effectively adapting to technological advancements by prioritizing the hiring or development of new skills within their teams.

The Fintech Fusion

Fintech Fusion represents the powerful convergence of finance and technology, driving innovation across payments, lending, and investment. The rise of fintech has reshaped the industry, creating new roles that demand a hybrid skill set, those who can understand both the language of finance and the tools of technology. In the realm of fintech, integrating reliable pos software can streamline transaction processing and enhance security measures. This trend is reshaping hiring priorities across the board.

A report by the Financial Services Skills Commission (FSSC) reveals that one in every eight roles in the financial services sector is now tech-focused, highlighting the sector’s shift toward technology-driven expertise.

Skill-Based Hiring Impact

As the finance industry continues to adapt to rapid technological change and shifting workforce expectations, both employers and job seekers are experiencing the impact in different ways. New hiring practices, especially those focused on skills over credentials, are starting to reshape the recruitment landscape. While these changes bring new opportunities, they also create fresh challenges, making it essential to understand how both sides of the hiring equation are navigating this evolving environment. Additionally, for finance companies looking to expand internationally, completing a company registration for foreign investors is a crucial step to ensure legal compliance and access to global talent pools.

Impact on Employers

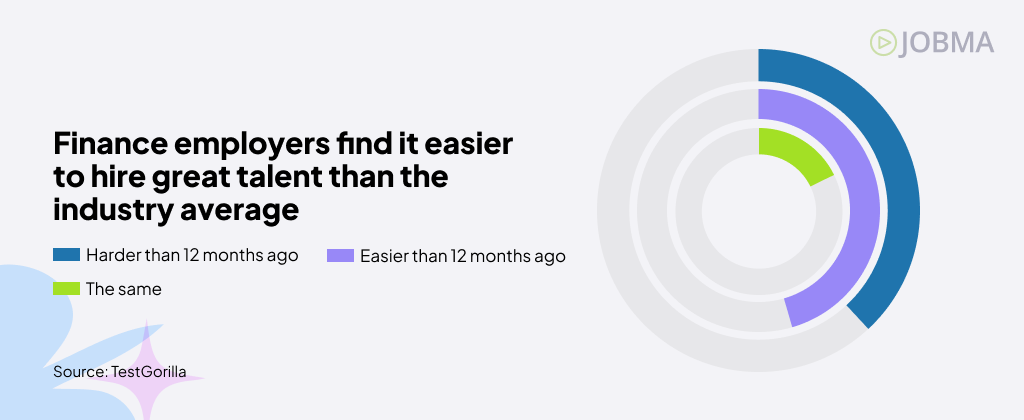

Finance employers are finding it easier to attract top talent compared to the broader market. While 51% of employers across industries say hiring has become more difficult in 2024, only 38% in the finance sector report the same. 46% of finance employers say hiring has become easier, with 16% seeing no change from the previous year.

One possible reason for this advantage is the finance sector’s stronger adoption of skills-based hiring. Many finance organizations are increasingly using multi-measure testing, an approach that combines skills assessments and job-relevant tasks to better evaluate candidates and make more informed hiring decisions. This approach makes it easier for firms to hire specialized roles, including cross-border financial advisors who can manage clients and compliance across multiple countries.

Impact on Employees

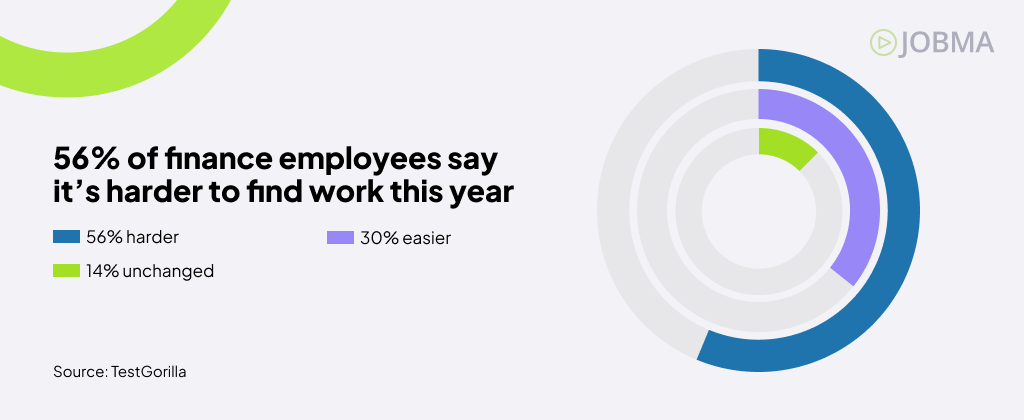

More than half of finance employees feel that finding work in 2024 has become more challenging compared to the previous year. While 30% say the job search has become easier and 14% feel there’s been no change, the majority report increased difficulty navigating the market.

On a more positive note, hiring bias in the finance sector appears to be slightly lower than in other industries. Around 29% of finance job candidates report experiencing either conscious or unconscious bias during recruitment, just below the overall industry average of 31%.

Top Skills for Finance Professionals in 2025

The financial landscape and companies such as Abacus are undergoing a profound transformation, driven by rapid technological innovation, evolving market dynamics, and increasing regulatory complexity. As we move further into 2025, the demand for traditional finance expertise remains, but it’s increasingly complemented, and in many cases, surpassed by the need for skills that bridge the gap between finance and emerging technologies.

Professionals looking to thrive in this dynamic environment must cultivate a different skill set, blending robust analytical capabilities with digital fluency, strategic thinking, and strong interpersonal acumen.

Here’s a look at the top skills you should be focusing on:

Risk Management

What it is: This involves identifying, assessing, monitoring, and mitigating risks across an organization. It includes understanding potential threats, conducting stress tests, and performing quantitative risk analysis to protect stability and reputation.

Why it’s crucial: The financial landscape is more uncertain and complex than ever. Businesses need professionals who proactively manage risks, especially those related to economic volatility, payload in cyber security, and evolving global events

How to Upscale: To boost your risk management capabilities, consider professional certifications such as the Financial Risk Manager (FRM®) by GARP or the Certified Risk Management Professional (CRMP), which offer a comprehensive grounding in risk frameworks.

Supplement this by enrolling in specialized courses covering specific risk areas like credit, market, or operational risk, and actively engage in industry associations that provide valuable webinars and networking to keep you informed on emerging threats and best practices.

2. Financial and Data Analysis, Including Modeling

What it is: This encompasses the ability to interpret financial statements, analyze vast datasets, build complex models, and perform in-depth valuations and forecasts. It’s about turning raw data into actionable insights for strategic decision-making. A core part of this skill is understanding key accounting concepts such as the depreciation journal entry, which ensures accurate representation of asset values over time and impacts both profit calculations and tax planning.

Why it’s crucial: The finance industry is increasingly data-driven. Your ability to leverage tools like Excel, SQL, Python, R, Power BI, Tableau, and modern accounting software to extract, clean, analyze, and visualize data should be paramount. This allows for real-time scenario modeling and agile financial forecasting, essential for navigating economic volatility and supporting business growth. In this context, using project management software for accountants can help streamline workflows and ensure that data-driven insights are effectively implemented across teams.

How to Upscale: For this skill, pursue specialized certifications like the Financial Modeling & Valuation Analyst (FMVA®) from CFI (Corporate Finance Institute) or Wall Street Prep’s Premium Package, while simultaneously honing your data analysis prowess through certifications in SQL, Python, or data visualization tools like Tableau and Power BI.

Beyond formal training, seek opportunities to build complex models within your current role or volunteer for data-intensive projects to solidify your understanding and practical application, ensuring you can turn raw data into actionable insights effectively. Additionally, integrating a corporate performance management solution can elevate this process by aligning financial insights with strategic objectives, enabling more accurate tracking of KPIs, and ensuring that forecasting and budgeting are continuously optimized across departments.

3. Fintech and Digital Transformation

What it is: This is about being comfortable with and leveraging the latest financial technologies, including blockchain, cryptocurrencies, advanced payment solution platforms, robotic process automation (RPA), artificial intelligence (AI), and cloud-based systems. It also covers understanding digital transformation processes within finance. Integrating a financial reporting solution into this mix streamlines the preparation and analysis of financial statements, ensuring real-time accuracy and compliance. In this context, choosing the right merchant of record can simplify payment management and reduce financial risk.

Why it’s crucial: Technology is rapidly reshaping the finance industry, automating routine tasks and creating new opportunities for efficiency and strategic insights. Xero AP automation by TRAILD helps finance teams streamline accounts payable, cut down on manual work, and keep financial reporting accurate and up to date. Professionals who can implement, oversee, and adapt to these technologies will drive significant value.

How to Upscale: Upskilling in Fintech & Digital Transformation means becoming comfortable with the latest technologies by exploring certifications like the FinTech Industry Professional (FTIP™) from CFI or Harvard Online’s FinTech Certificate Program. Many professionals choose to pursue these through trusted online learning platforms, which provide flexibility, accessibility, and structured resources to support continuous growth.

It’s crucial to gain hands-on experience with concepts like blockchain and cryptocurrencies, understand how AI and machine learning are applied in finance, hire AI engineers to implement these technologies effectively, and actively participate in Fintech conferences and workshops to stay abreast of innovations and network with industry leaders.

4. Regulations and Compliance

What it is: A deep understanding of and adherence to the ever-evolving regulatory landscape, including tax laws, anti-money laundering (AML) regulations, foreign exchange rules, data privacy laws (like GDPR), and industry-specific compliance frameworks.

Why it’s crucial: Regulators are constantly adapting to technological advancements like identity verification platforms, blockchain technologies, AI advancements, and global shifts. Your ability to ensure business compliance and mitigate associated risks is essential for maintaining legal and ethical operations.

How to Upscale: To master Regulations and Compliance, prioritize obtaining specialized certifications like the Certified Regulatory Compliance Manager (CRCM) or Certified Anti-Money Laundering Specialist (CAMS, if applicable), while also subscribing to newsletters and publications from key regulatory bodies to stay informed about new laws and amendments.

Actively participate in internal compliance training within your organization and attend external seminars focused on current and upcoming regulatory changes, ensuring you can proactively mitigate risks and maintain legal operations.

5. ESG (Environment, Social, and Governance)

What it is: This involves understanding how environmental, social, and governance factors impact decisions and integrating ESG metrics into reporting. It also includes ensuring compliance with evolving sustainability standards and providing transparency on a company’s non-financial performance.

Why it’s crucial: Sustainability is a growing concern for investors, consumers, and regulators. Finance professionals need to be able to align operations with long-term sustainability goals, manage related risks, and meet stakeholder expectations.

How to Upscale: Aim for recognized certifications like the CFA Institute Certificate in ESG Investing, which provide a structured understanding of ESG integration. Complement this by enrolling in specialized courses on sustainable finance and corporate social responsibility, consistently reviewing industry reports from organizations like GRI(Global Reporting Initiative) and SASB(Sustainability Accounting Standards Board), and actively seeking opportunities to volunteer or network within sustainability initiatives to gain practical exposure and build connections.

6. General Business Skills (Soft Skills)

What it is: This category includes a range of interpersonal and cognitive abilities that enable effective work within an organization. Key aspects include communication (verbal and written, including storytelling with data), problem-solving, critical thinking, adaptability, strategic thinking, and collaboration.

Why it’s crucial: While technical skills are fundamental, soft skills are what allow you, as a finance professional, to translate complex information into actionable insights, influence stakeholders, and work effectively across departments. The move towards finance business partnering further emphasizes these skills.

How to Upscale: To enhance your General Business Skills, focus on refining your communication by enrolling in workshops for business communication, presentation skills, and the art of storytelling with data. If you aspire to leadership, consider leadership development programs that focus on influence and team management, and always seek out mentors within your industry who can guide your development.

Actively volunteer to lead meetings or present findings, engage in cross-functional projects to foster collaboration and problem-solving, and regularly seek and reflect on feedback to continually improve your critical thinking and adaptability. Attending sessions by a growth AI keynote speaker can further provide inspiration, real-world examples, and actionable strategies to enhance soft skills, including strategic thinking, leadership, and influence.

Conclusion

Hiring for skills instead of titles is a major shift in how companies think about people. As careers become less linear and old job ladders break apart, the businesses that focus on the skills they truly need will come out ahead.

For job seekers, the future of finance careers puts the spotlight on learning useful abilities: a degree or fancy job title alone won’t open doors anymore. You need to prove what you can do through real examples like side projects, work samples, or an online portfolio.

Managers and leaders have to rethink what “qualified” looks like, experiment with how they build jobs, set pay, and offer growth paths.

The change can feel tough because it challenges long-held habits, but teams that adopt skills-based hiring end up with a workforce that is more adaptable and ready for anything. Putting skills and potential first, rather than prestige, releases fresh talent and sparks new ideas, which helps individuals, companies, and society as a whole.

FAQs

Is an MBA still valuable for a career in finance?

Yes, an MBA still offers a strong foundation in strategy, leadership, and networking, but it is no longer the single golden ticket. Employers now treat it as one signal among many and will weigh it against proof that you can use modern tools, interpret data quickly, and add value from day one.

What skills are employers looking for in finance today?

In 2025, finance employers are looking for a mix of technical, domain-specific, and soft skills. Key examples include:

Technical: Financial modeling, advanced Excel/VBA, Python or R for data analysis, SQL, and visualization tools such as Power BI or Tableau.

Domain: Risk management, fintech fluency (payments, blockchain, AI-driven analytics), and up-to-date knowledge of regulations and ESG reporting.

Soft: Clear communication, critical thinking, and the agility to learn new systems fast.

What certifications are replacing MBAs in finance hiring?

They are not fully “replacing” an MBA but often serve as more targeted proof of ability:

- CFA (Chartered Financial Analyst) for investment analysis

- FRM (Financial Risk Manager) for risk roles

- FMVA (Financial Modeling & Valuation Analyst) or Wall Street Prep for modeling

- CAIA(Chartered Alternative Investment Analyst) for alternatives

- CAMS(Certified Anti-Money Laundering Specialist) for compliance/AML, and

- Fintech-specific badges, such as FTIP(FinTech Industry Professional) or university-backed certificates in AI, blockchain, or data science.

How can candidates prepare for skill-based hiring in finance?

To close the gap between where you are and where employers need you to be, follow these steps:

- Map the skills gap: Compare job ads to your current toolkit and list what’s missing.

- Earn proof: Complete short, reputable courses or certifications that fill those gaps.

- Build a portfolio: Publish models, dashboards, or code on GitHub or a personal site; include anonymized work samples if possible.

- Practice assessments: Many firms now use online skills tests, run through practice cases and timed modeling challenges.

- Network and learn continuously: Join finance and fintech forums, attend webinars, and stay current on emerging tools so you can demonstrate fresh, job-ready expertise.